Understanding the 30C EV Charging Tax Credit

Learn about the latest guidance on EV charger tax credit eligibility for individuals and businesses provided by the US Treasury Department. This information is essential as tax season approaches.

The 30C EV charging tax credit

Discover how the Inflation Reduction Act introduced a tax credit for qualified EV charging property, now applicable per single item of EV charging property. The IRS Form 8911 is crucial for claiming the tax credit, offering benefits of up to $1,000 for home EV charging and $100,000 for business properties.

Explore how the tax credit can be claimed through direct pay, benefiting eligible entities investing in EV infrastructure. This change came into effect on January 1, 2023.

Location, location, location

Discover the importance of being in an eligible census tract to qualify for the 30C EV charging tax credit according to the IRS’s latest guidance. An eligible census tract is defined as a low-income community or a non-urban area.

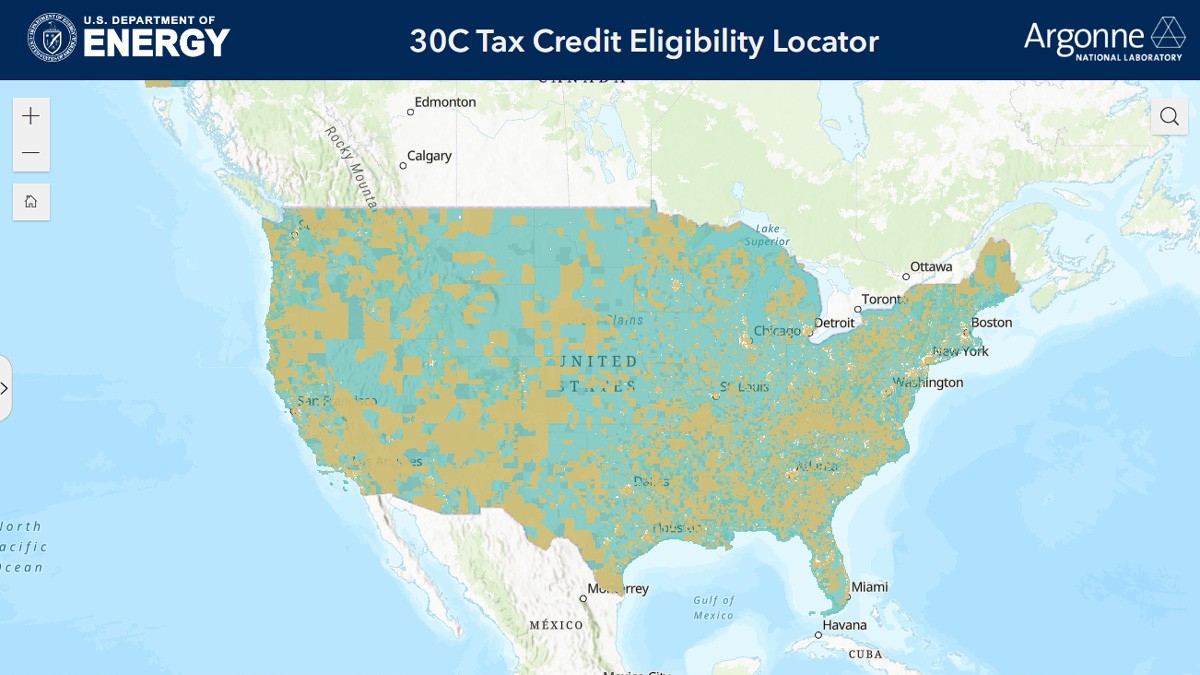

Learn that two-thirds of Americans can benefit from the Inflation Reduction Act‘s 30C EV charging tax credit, as confirmed by the White House. Use the mapping tool released by the US Department of Energy and Argonne National Laboratory to determine eligibility.

Understand the significance of the 30C tax credit in driving the transition to electric vehicles, with the goal of deploying 500,000 public chargers by 2030. Get insights from ZETA’s executive director, Albert Gore III, on the importance of effective implementation.

Access the 30C Tax Credit Eligibility Locator map here.

Find helpful FAQs about the 30C tax credit here.

Read more: Calculate how much you can save with the Inflation Reduction Act

If you own an electric vehicle, consider charging it at home with rooftop solar panels. Find trusted and competitive solar installers near you through EnergySage to go solar easily and save money.

Compare personalized solar quotes online and get assistance from Energy Advisers every step of the way. Get started here. –ad*

FTC: We use income earning auto affiliate links. More.

Read More of this Story at electrek.co – 2024-03-11 20:03:21

Read More US Economic News

e8lzln